tax relief 2018 malaysia

If you have deposited money into your SSPN account in 2018 then this amount can be claimed in your e-BE form as well. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying.

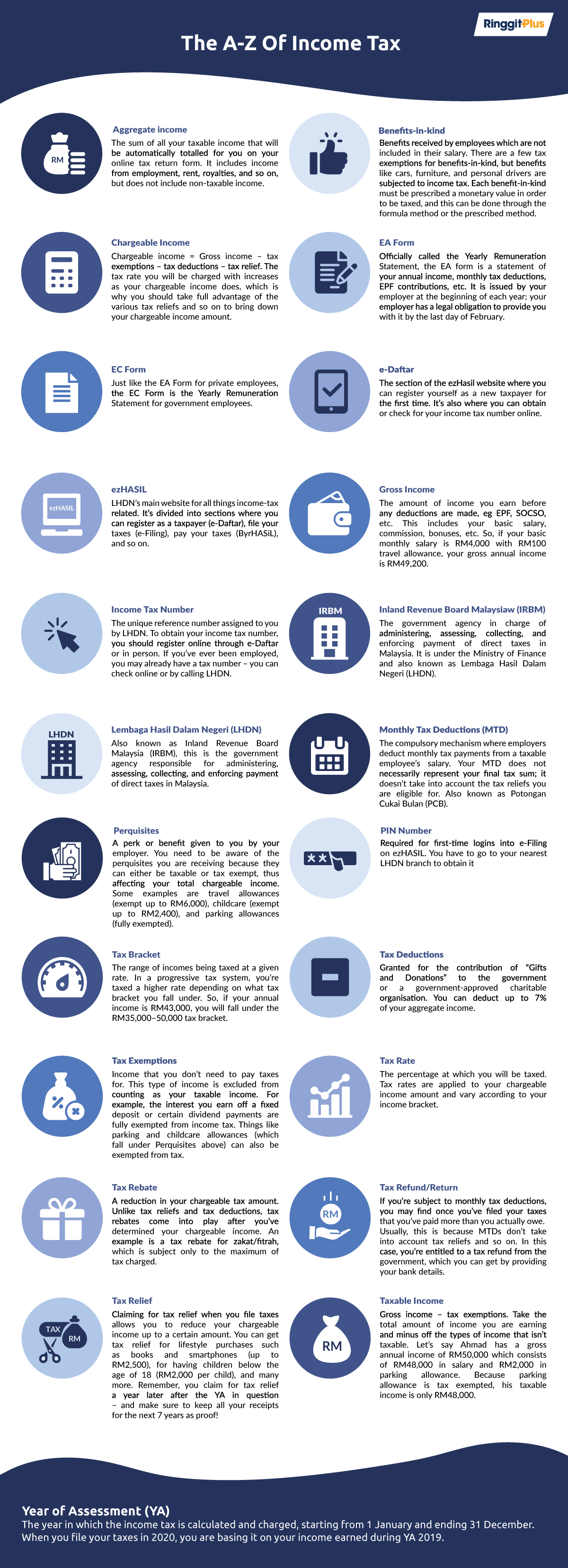

This infographic will give you an overview of all the tax deductions rebates and reliefs that you can claim for YA2020.

. As long as your total deposit in the year 2018 is larger than your total withdrawal youre eligible for a tax relief of your net balance up to RM6000. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income. On the First 5000 Next 15000.

10 tax rate for up to 10 years for. Income tax relief Malaysia 2018 vs 2017 Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. Relief for error or mistake or inaccurate tax returns Application for relief can be made to the Director General of Inland Revenue DGIR for tax returns which are incorrect due to the.

If planned properly you can save a significant amount of taxes. In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

However with the self dependent tax relief. 12 rows To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals. It is a combination of the tax relief for reading materials up to RM1000 a year computer up to RM3000 every three years and sports equipment up to RM300 a year.

Personal income tax in Malaysia is charged at a progressive rate between 0 28. For example you have until April 15 2024. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

In our example a taxpayer would have been taxed about 10 of his total chargeable income of RM84300 if he had claimed no tax reliefs at all. The amount of tax relief 2018 is determined according to governments graduated scale. However any amount that is withdrawn after your first.

On the First 20000 Next 15000. IRBM has issued Public Ruling PR No42018 dated 13 September 2018 in relation to the personal reliefs under the title of Taxation of a Resident Individual Part 1- Gifts. For income tax Malaysia tax reliefs can help reduce your chargeable income and thus your taxes.

Tax exemption malaysia 2019. All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for. Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September. 0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia.

On the First 5000.

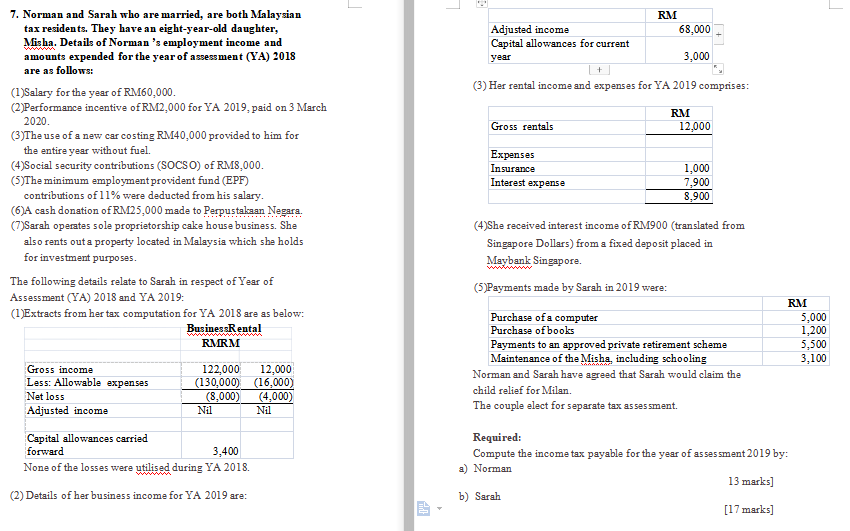

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

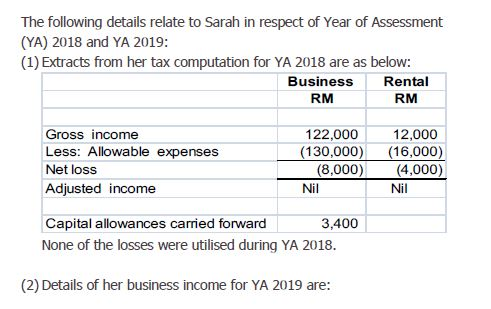

7 Norman And Sarah Who Are Married Are Both Chegg Com

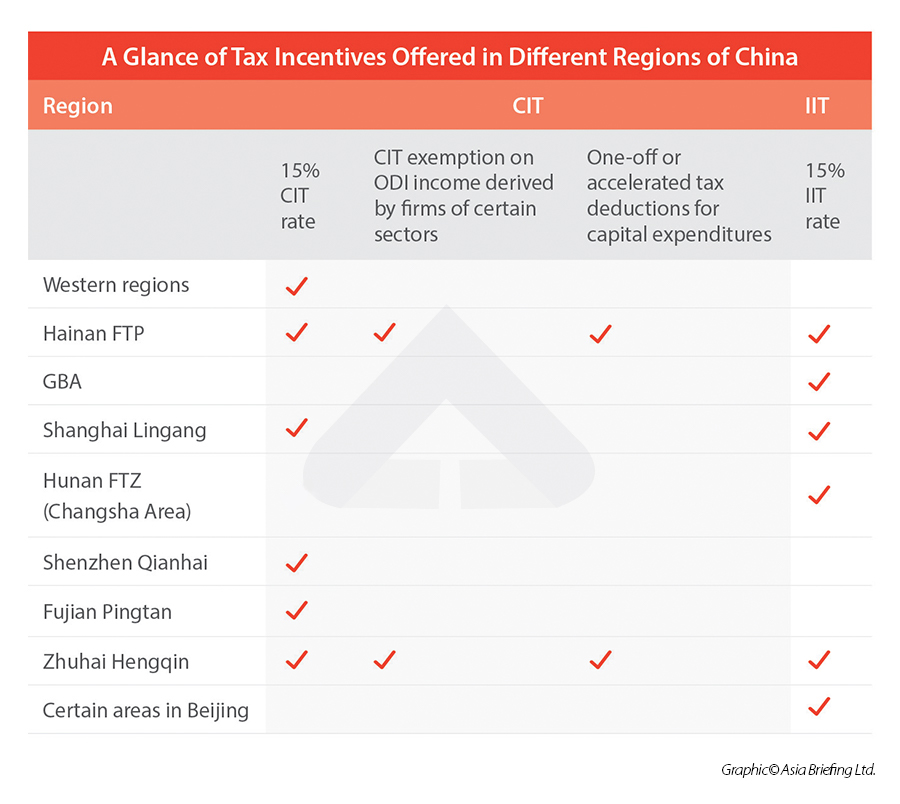

A Comprehensive Summary Of Region Wise Tax Incentives In China

My Personal Tax Relief For Ya 2018 The Money Magnet

Individual Tax Relief For Ya 2018 Kk Ho Co

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

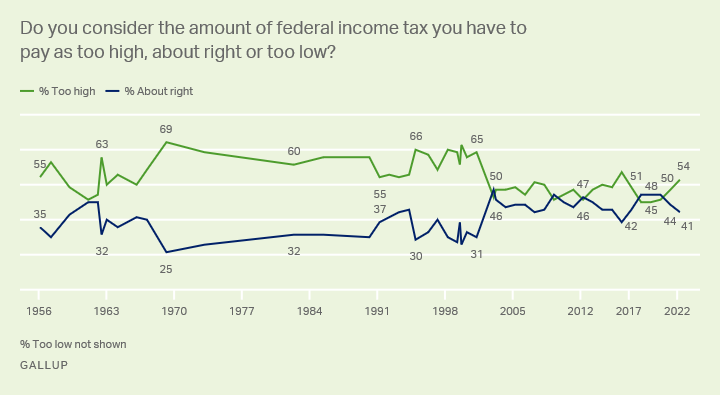

Taxes Gallup Historical Trends

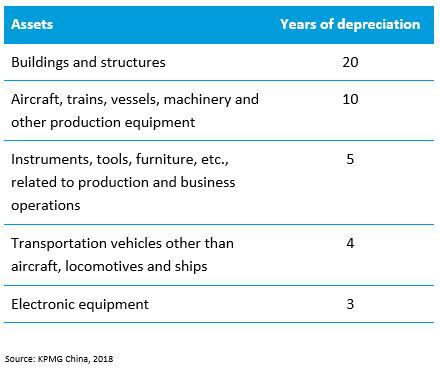

China Taxation Of Cross Border M A Kpmg Global

Malaysia Income Tax An A Z Glossary

A Guide To Malaysian Tax For Expats

Covid 19 Significant Improvements Are Needed For Overseeing Relief Funds And Leading Responses To Public Health Emergencies

Country Reports On Terrorism 2018 United States Department Of State

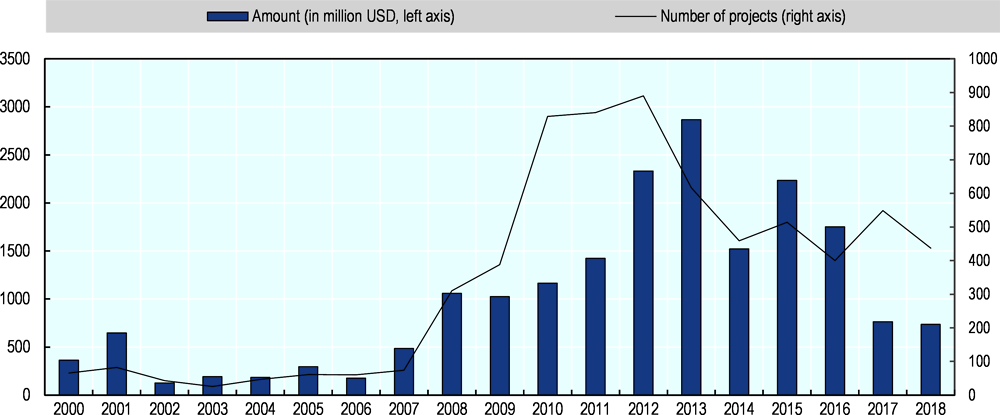

6 Tax Policy For Investment Oecd Investment Policy Reviews Uruguay Oecd Ilibrary

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Income Tax Malaysia 2018 Mypf My

The State Of The Nation Should Epf Tax Relief Be Reduced Next Year The Edge Markets

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical Insurance Read This Ibanding Making Better Decisions

Comments

Post a Comment